As part of the Government’s efforts to address Singapore’s falling total fertility rates (TFR) – which hit a record low of 0.97 in 2023) – Prime Minister Lawrence Wong announced a new Large Families Scheme to support married couples who have, or aspire to have, three or more children in this year’s Budget.

This new Large Families Scheme entails:

- A $5,000 increase in the Child Development Account First Step Grant. This will apply to each third and subsequent child.

- A new $5,000 Large Family MediSave Grant. This will be disbursed into the mother’s MediSave account again for each third and subsequent child.

- $1,000 in LifeSG credits to be disbursed annually to families for each of their third and subsequent children, during the years that the child turns one to six.

While we believe that societal values are more important in shaping fertility rates as compared to financial support, material and practical forms of support would certainly be beneficial.

Findings from our 2024 “Marriage, Family and Social Discourse” survey suggest that there are families in Singapore who could possibly decide to have more children and realise their ideal family size, if the circumstances are right. In fact, out of over 1,200 married respondents, 24% cited three or more as their ideal number of kids, but only 10% reached their ideals.

Yet, support needs to be more systemic and structural to be fiscally sustainable in the long run. Otherwise, pure monetary “handouts” may inadvertently promote a culture of dependency or of measuring childbearing and childrearing in financial terms alone.

The Government cannot do better for families than what families can do for themselves, including to provide love, care and support for children over the long term. A more socially and fiscally sustainable long-term approach may instead be focused on empowering families or lowering barriers for families to better do and provide for themselves what they naturally would. Some barriers are the result of existing government policy, such as Certificate of Entitlement (COE) and Housing and Development Board (HDB) flats.

Here are some of our suggestions:

1. Transport

Bringing multiple children from place to place is highly challenging, due to the needs to ensure their safety and wellbeing. Public transport, private hire and taxis may be an option, but each present their challenges in terms of accessibility. At the same time, to own a car in Singapore, one must first obtain a COE. High COE prices have been a concern for some time, making car ownership difficult for families (especially larger families).

Practical solutions to transport challenges might include:

- COE priority scheme. A priority scheme of COEs for families and caregivers of young children, the elderly, persons with disabilities and those with serious health conditions. Such a scheme could involve a partial COE waiver if certain conditions are fulfilled, or the introduction of a separate COE category. As larger families need larger cars (and road safety rules require the installation of child car seats, which are bulky and occupy large spaces); these families should be given special allowances for larger cars.

- Private hire. Increase family-friendly options for private hire vehicles, by making car seats for children more readily available in more private hire vehicles, although we recognise that there are market-oriented considerations for such moves.

- Accessibility of public transport. Improving accessibility in the public transport system for young children (and other vulnerable groups, such as elderly and persons with disabilities), such as by creating priority lanes for embarkation and giving priority in usage of lifts.

2. Housing

Observers have noted that HDB flats have “shrunk” in size over the years. Furthermore, the sizes of flats range between 2-room to 5-room, three-generation (3Gen) or executive. For large families, these create real space constraints, as they naturally need more space in their house.

Thus, the Government may need to consider the following:

- Larger homes for larger families. Build and allocate larger homes for larger families, including executive maisonettes and jumbo flats, especially in locations near schools.

- Home-related subsidies. Explore options to give more home-related subsidies for families that have more children.

3. Grandparents who provide childcare support

Dual-career households are now the majority in Singapore, where both husband and wife work. Singapore boasts high levels of female workforce participation, at 62.6%, higher than the OECD (Organisation for Economic Co-operation and Development) average of 56.7%. The Government has been encouraging employers to employ seniors, including in the latest Budget measures.

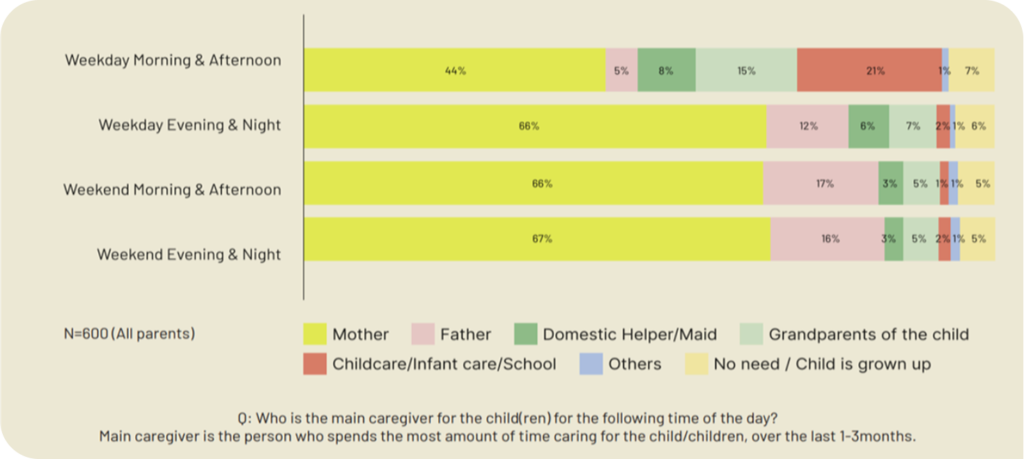

Conversely, our 2024 Parenthood and Work survey found that grandparents are the third most common as main caregivers of children (15%) during working hours (i.e. morning and afternoon) on weekdays. They rank behind mothers (44%) and institutionalised childcare or schools (21%).

In the video that Minister Indranee Rajah posted on Facebook, the couple – Eric and Natalia – shared about their family with three children, and added that they receive support from their children’s grandparents.

To rebalance work and family life, and strengthen the caregiving ecosystem for children, it would make sense to help the different generations provide better support to one another. As grandparents may still be working, childcare leave for working grandparents may be helpful, to enable and encourage the involvement of senior men and women in their grandchildren’s lives.

Beyond that, there is room to enhance proximity grants for HDB flats in relation to families with young children and/or large families, to enable grandparents to live near their grandchildren and for families to provide mutual support.

4. Tax reliefs for working fathers of large families

Currently, there are tax reliefs for working mothers, in the form of the Working Mother’s Child Relief (WMCR). However, there is no corresponding tax relief for working fathers (whether they are parents of large families, or otherwise).

In Singapore, many fathers remain sole or main breadwinners in a significant number of families in Singapore, and it may be impractical to give tax reliefs to all working fathers.

However, there is room for more sustained support for larger families, where one parent (typically the father) becomes the sole breadwinner, while the mother takes on sole caregiving responsibilities (especially if the children are younger). Tax reliefs for such working fathers of large families may be helpful.

5. Rebalancing work and family life

The Government has been taking steps to increase parental leave and encourage the adoption of flexible work arrangements (FWAs).

At the same time, there is a risk that parental leave increments may backfire and lead to increased discrimination against parents (not all of which can be successfully tackled by the Workplace Fairness Act).

For a more sustainable approach, it would make sense for the Government to continue encouraging the adoption of FWAs. This will be beneficial not only for parents, but also other caregivers such as individuals taking care of the elderly and persons with disabilities.

Apart from that, some individuals may take breaks from work or career to take care of children (or other persons such as elderly or persons with disabilities). These people should not be penalised or stigmatised when they try to re-enter the workforce.

Finally, it would help with manpower gaps, if there could be nurtured in Singapore an industry of temporary hires and to facilitate job matching to fill gaps that arise when parents or other caregivers take prolonged leave or breaks from work. This could involve working with job portals to build a readily available pool of such covers, as well as offering grants or tax incentives to smaller businesses to hire temporary staff to cover for employees who take leave or breaks.

Valuing Children

We hope our suggestions, aimed at more systemic and structural forms of support, will help married couples who have or are planning to have larger families. Indeed, at the close of the Budget debates, the Government said it “will study” suggestions on large families including needs for larger housing, difficulties getting around as a family, or the costs of higher education.

In the long term, there are deeper issues concerning our societal values: Do we value children, as well as family and marriage? What are other priorities that we place ahead of them? Have we grown too materialistic, or too focused on certain narrow ideas of success and do we expect children to live up to all these ideals?